In addition to paying at Basel shops with credit cards, direct debit or cash, you’ll need to pay bills that come to you, either by mail or electronically, for rent, water, power, TV, phone, etc. Depending on what you’re used to in your home country, you might find paying your bills in Basel a bit different than what you’re used to. Personal checks are not used in Switzerland in general, but there are several other options to pay things.

In addition to paying at Basel shops with credit cards, direct debit or cash, you’ll need to pay bills that come to you, either by mail or electronically, for rent, water, power, TV, phone, etc. Depending on what you’re used to in your home country, you might find paying your bills in Basel a bit different than what you’re used to. Personal checks are not used in Switzerland in general, but there are several other options to pay things.

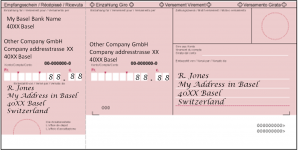

Payment slips (orange and red)

In Basel and the rest of Switzerland, slips of orange or red paper are come with most bills, often under the breakdown of the bill as a tear away sheet). On these slips there will be pre-printed information or blank spaces for or the payee (the company or person you owe money to), payor (you), the amount due and detailed bank account information. The German term for these slips is ‘Einzahlungschein’.

Most of the bills you receive from the larger companies (phone, tv, power, etc) will be of the orange type. Orange payment slips have a unique 27 digit reference number (called the ISR or ESR number) for that payment allowing companies to keep track of your payments easily. Red paying in slips do not generally have the reference number. These red slips are often provided by smaller businesses, individuals or for one off services. The ‘orange’ payment slip is a very light orange, and the ‘red’ paying in slips are closer to a light pink. If you bank online, be sure to look carefully to determine what color your bill is.

More and more companies are providing online bills, without payment slips, which just provide you with the information of the specific payment without a slip. If you’re just provided with bank account info (an account or IBAN number), you’ll probably select the tab to pay a red slip when paying online. If they give a unique 27 digit ISR reference number with the payment, then you’ll likely have the equivalent of the orange payments slip. My mobile phone company now does this, since I requested they go paperless. If you have any question on which type of payment to make, just call the person or company you plan to pay and they will be able to tell you.

The red payment slip:

- This is a method to transfer money into the bank account of a person or company

- The payment slip shows the IBAN of the person/company you’re paying as well as what bank they use

- The amount due and the payer’s details may be pre-printed by the payee or you might have to fill in the amount and your name and address

- You should put a short of the reason for payment in the specified field, so both you and the person you are paying know what this is for!

The orange payment slip:

As above, but with an account number (generally 9 digits, in the following format 12-345678-9), and the 27 digit reference number. There is no message field for the recipient (the reference number makes this unnecessary).

There are numerous ways to pay these bills:

- Pay from your online bank account

- Step up a standing order for direct debit from your account

- Pay at your bank (live with the teller)

- Pay at the post office

- Pay at a bank machine

1. Paying bills in Basel from your online bank account

Regardless of which bank you signed up with, or if you have a post office account, you should have an option to pay your bill from your computer. I won’t go into specifics on how to do this, as each bank’s online banking platform is unique. Generally, you need to look for a tab or button, marked ‘payments’ or ‘pay bills’, and then you’ll be able to choose between orange payments slips, red payment slips and often also be able to select foreign and domestic bank transfers.

Many online interfaces for banks allow you to save a company you made payments too, so that you don’t have to enter the information from scratch every time. If you use this function, be sure to check the reference number or other specific information is correct every time!If you have difficulties figuring out your interface, most banks have a helpline, or online chat, where you can seek assistance. When you pay your bills online, payment is usually executed the following day, so if you need to cancel or correct the payment for any reason, you might be able to do this for several hours after you complete the payment online (look under pending payments). You should always check a couple of days after paying to make sure that the payment went through. It’s also a good idea to write the date you paid on the payment slip, and keep this for several years (at least!). Most banks also have a mobile phone app which you can use to pay your bills if you prefer.

2. Setting up a standing order/direct debit for regular bill payments from your bank account

You can authorize your bank to make payments to specific companies for regular costs. I do this for rent, health insurance and other regular, fixed cost bills. Bills that are not the same month to month, can also be authorized (phone, etc) as a standing order/direct debit but I would think twice before paying this type of bill as a standing order, in case you have need to dispute your bill. It’s easier to do this if you have not yet paid them!

3. Payment at any branch of your bank.

If you prefer to pay in person, and have a paper record of the transaction, you can go to your local bank branch (generally you have to have an account there). You can give the teller your account information and your payment slips, and they can pay these out of your account. You’ll either receive the stub of the payment slip stamped by the bank as proof of payment, or, if you pay multiple bills at once, they’ll pool them and generally give you one stamped slip reflection the total of all the payments. You should keep these stamped stubs as these are your only record of payment. If you have a cash heavy business, you could also pay these bills at a branch of your bank in cash, but you still have to have an account there.

4. Paying at the post office:

In Switzerland, the post office is also very much like a bank. If you have a PostAccount you’ll be able to pay online, or if you go to a branch to pay out of your PostAccount. If you prefer to pay your bills in cash, you can take cash and your payment slips to any post office. You do not need an account with them. Just walk in, take a number or wait in line, and give the teller you slips and the cash (you don’t need exact change). In return, they will do the payment and give you back stamped payment stubs from your slips, that you should keep as proof of payment.

5. Paying bills at the bank machine

Some banks have bank machines where you can make your payments. Make sure your bank has this function before you open an account if you want use this function. You’ll only be able to do this at machines where you have an account (and if that machine has the ability to accept this type of transaction). After you’ve inserted your bank card and given your PIN, you can select pay bills, and feed in your payment slips. Then you just need to authorize payment at the machine.

If You Don’t Pay Your Bills on Time

Most bills have a pay before date; and if they don’t you can contact whoever is billing you for a due date. For most bills the payment period is 30 days. If you don’t pay by the specific date, you generally get a warning, followed by a service charge, which can range from 20-100CHF (I could also imagine this being higher, depending on the company and the size of the bill). You’ll also likely incur some sort of interest on the payment in addition to this.

If you still don’t pay, the billing party will report you to the ‘collection authorities’ that will summon you to their office, or hire a bill collection agency that will try to find you to get the payment. This will incur all sorts of additional charges on top of the original bill, and can lead to issues on a larger scale (court cases, evictions, getting a flat in the future).

If you still don’t pay, the billing party will report you to the ‘collection authorities’ that will summon you to their office, or hire a bill collection agency that will try to find you to get the payment. This will incur all sorts of additional charges on top of the original bill, and can lead to issues on a larger scale (court cases, evictions, getting a flat in the future).

If you have a problem with a bill you received, mail a written letter to the supplier, by registered mail. Then, follow-up with a call to try and resolve the issue. If this fails, you can seek arbitration from a third party (if both parties agree). Failing this, you should seek legal help to resolve the issue in the court system. Do yourself a favor. Do your best not to let it get this far!

Bill Paying Scams

There are some scams running in Switzerland where companies send you a payment slip and a bill for services that you did not receive. Just because you receive a bill from someone it doesn’t mean you have to pay it. Those running the scam hope you’ll not look at what the charge is for and pay it regardless. Don’t fall into this trap. If you get a bill that you don’t think you owe money for, be sure to contact the biller to resolve it. If you are certain it’s a scam, scan the bill and file a report with the Basel police.